Don’t we all want to be able to live the best possible life? To give our children the financial head-start we had or wished we had? To get our money working for us?

We’re quite sure the answer to that is yes! But the more important question is how do you get there? And that answer is rather simple: Forget all about saving, investing is the most efficient and clever way to achieve these goals.

Well, you might think… “Investing means living in fear that I bet on the wrong horse”, “I need a lot of money to be able to invest”, and in times of Corona isn’t it “the most reckless thing to do”? Or is it?

Our guidelines for getting investments right – for those of you new to it and a reminder for everyone else who is already at it:

The basics

A solid and detailed financial plan is key to ensure the money you plan on investing is not money you need. Wealth management and accumulation come after the basics are covered and you are 100% certain that all elemental risks have been assessed and covered. Investing borrowed money or liquidity you do not actually have is a no-go. What is more, for long-term successful investment of any kind, a slow and steady but also very well-monitored approach reaps the juiciest fruits in the end. Once that foundation has been properly tended to and you have the means and wish to invest then we recommend you to: Define an investment period. The kinds of investment portfolios we prepare for our clients to start at 5 years-time (excluding real estate) and span out to even over 50 years. A recommended span for mid-term investment lies between 5-15 years, depending on the financial instruments chosen. To make sure you choose the right one… Make a plan! How does your investment fit into your life-plan? What are your personal goals in the next years? When do you need capital to fulfil them? Are we discussing short (0-5 years), mid (6-15 years), or long term (>15 years)? Empirically assess your investment mentality! Only after you get a proper assessment you can be assured that your investment really fits your demands. Furthermore, it will help you to realistically forecast what you might expect from your investment in all scenarios. Decide on frequency. Once? Monthly? Mix and match? Inform yourself which options require a monthly investment and for which ones a one-time payment suffices to achieve your goals. Ask yourself: Am I afraid of fluctuation? Putting all eggs in one basket is one of the most common mistakes when investing. Diversification can be achieved through different strategies, too, so it is not only about integrating different financial tools into the portfolio. Define what flexibility means for you. How important is it for you that your money can be easily accessible? Are you willing to accept the risk of potential losses for the prospect of much higher returns? How involved do you want to be and how often do you plan on checking it? Do you wish to reinvest your gains? Our job as financial consultants at HORBACH Munich Expats Team is to aid you in these matters and provide you with professional advice and tailored solutions. We are also very happy to work together with those of you who have investments world-wide to help you fit those into the new portfolio. Our investment specialists help you step by step.Should you be investing? What could it look like for you?

Regardless of your age, your profession, and your plans – there is an opportunity to support every expat, including you! What matters is your personal situation. – Your risk mentality defines which options fit you: are you looking for high profit, safety or both? – Your personal plans determine the investment period: are you planning on building a house or do you want to travel the world with your soon-to-be reserve funds? – Your country of origin determines which investments are accessible to you. To illustrate what is possible for you we have created a few scenarios to help you figure out which kind of investments suit you best. Did you know that to start with investing you don’t have to venture onto the stock market (yet)? There are stock-market independent options available for you. In fact, there is not just one, but three main stock-market independent financial instruments that will help you increase your wealth.Option 1

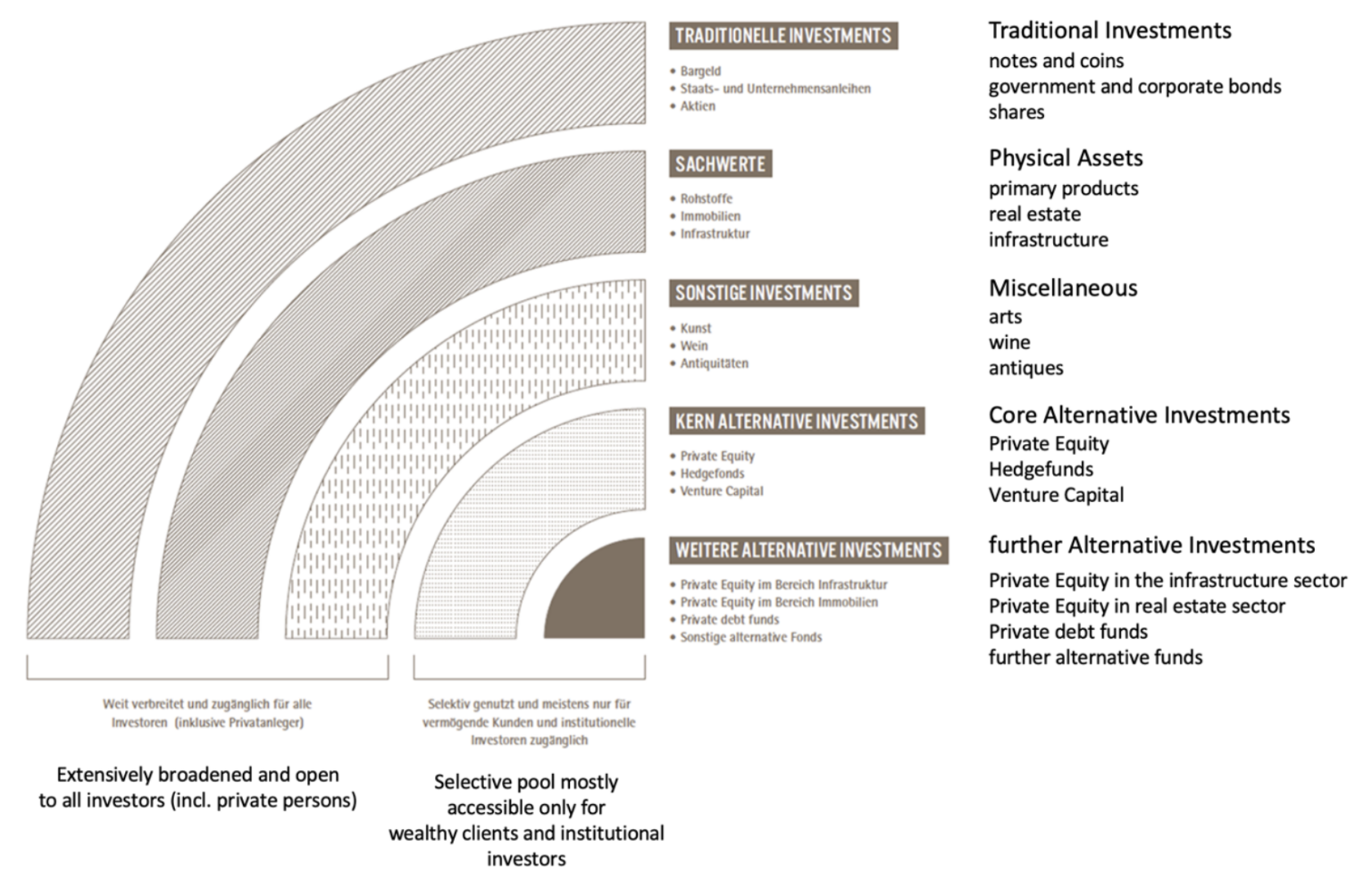

Alternative Investment Funds (AIFs):

Small sums going long ways

Suitable for: Anyone wanting to take part in unique world-wide projects for 5 to 14 years looking to maximize their profits. You appreciate having an experienced guiding hand while still benefitting from exclusive opportunities and extraordinary returns.

Why it is profitable: a plethora of worldwide real estate and infrastructure projects are bought, renovated, indexed and sold by large investment groups. This cycle is repeated twice or thrice to guarantee a maximum return. Though you cannot access your money during that period, the investments are protected.

Insider tip: While private investors usually need a sum of 250.000 € to participate, you can already invest in AIFs with small contributions via the cooperation between HORBACH Munich and the investor groups. Our high-end portfolio grants our clients the exclusive possibilities otherwise inaccessible for private persons.